In finance, keeping up to date is a constant necessity for companies. Especially if they want to stand out and succeed in today’s market.

Today we want to share with you a success story of a well-known company in the financial sector based in Bucharest, Romania. It has more than 5000 employees and a solid reputation in the market. This organization is a perfect example of how the adoption of cutting-edge technologies drives business growth.

Disclaimer:

For confidentiality reasons, we cannot disclose the name of the company in question. Therefore, we will refer to it by a fictitious name: AvanceCapital.

However, what we can share is how the implementation of the ServiceNow platform has been key in the digital transformation of this company. Enabling them to improve their internal processes, increase operational efficiency and deliver exceptional customer service.

Join us on this journey to discover how ServiceNow has been the catalyst for revolutionary change at this leading financial firm.

How to achieve a successful financial digital transformation?

AvanceCapital was known for its excellence in the financial sector. However, it faced internal challenges that threatened its ability to remain a leader in its field.

First, its IT support system was decentralized. And it relied heavily on email and Excel to handle requests.

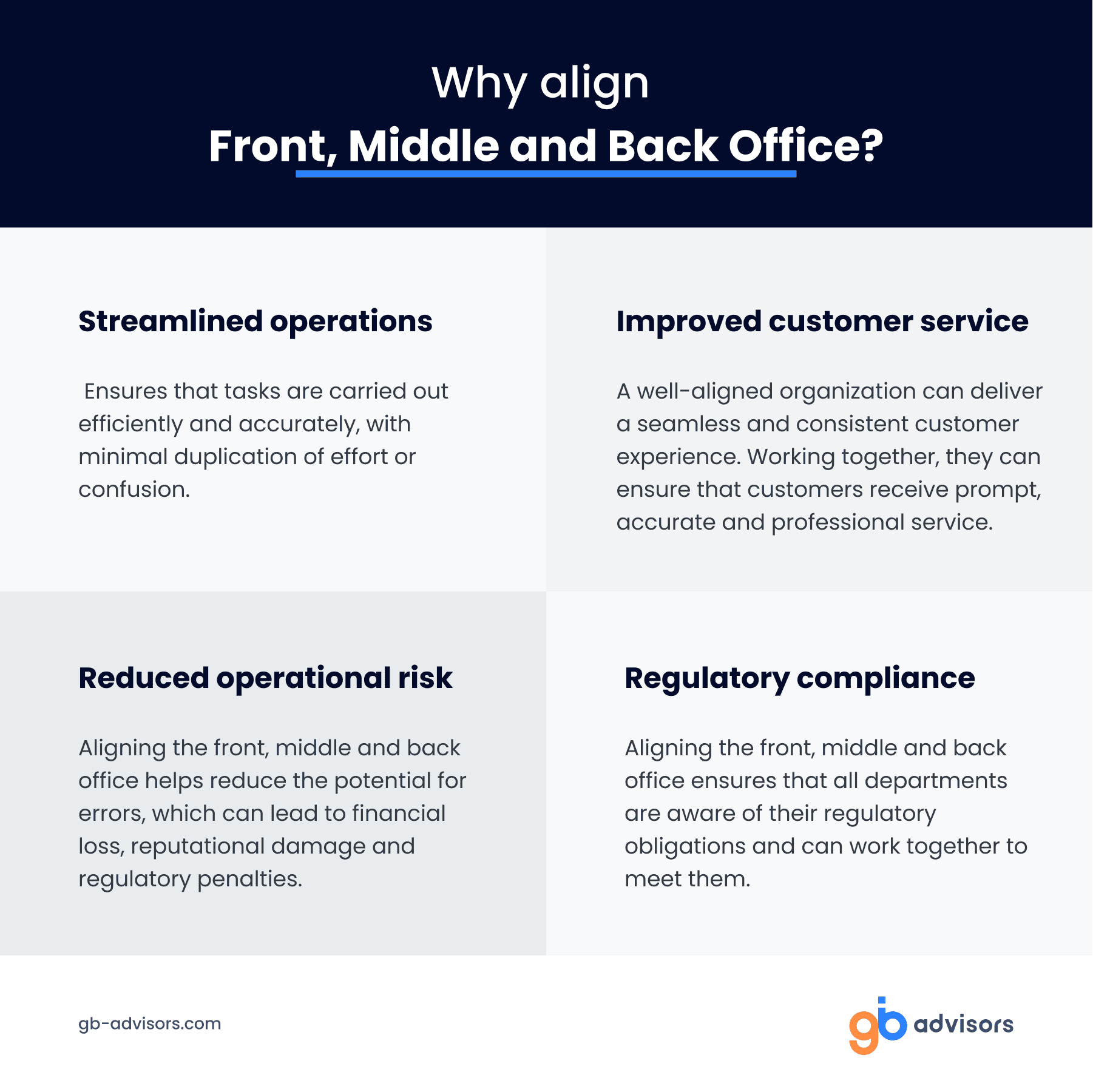

Uncoordinated processes and a lack of platforms to collaborate were a problem. Especially not being able to connect Front, Middle and Back Office.

This situation became even more worrying when the company wanted to undertake new projects. For example, when they wanted to optimize their digital channels and services.

How could the company offer new digital services if it did not invest in a digital transformation from within?

The C-Levels met and concluded that it was necessary to optimize IT service management and operations. The goal was to align efforts across all lines of business. And in this way, make future customer service digitization projects possible.

The challenge: Optimizing service operations

The main issue facing the organization was the lack of transparency around IT services. And the absence of the necessary infrastructure to support those services.

Inevitably, this led to operational inefficiencies. Employees could not easily access the information they needed to make informed decisions and provide quality service to their customers.

The company’s ServiceNow administrator says, “Workers had to resort to using email to report issues, often just when their own email was failing. It was also difficult to get an accurate picture of the situation from our employees and customers.”

To address these challenges of financial digital transformation, AvanceCapital decided to implement an IT service management solution based on the ServiceNow platform.

The main objectives were as follows:

- Centralize and standardize IT processes.

- Improve internal communication.

- Provide visibility of IT services and infrastructure.

The solution: ServiceNow, a partner for financial digital transformation

Now, aware of the need to overcome these obstacles, AvanceCapital decided to test the implementation of ServiceNow. A leading enterprise service management platform.

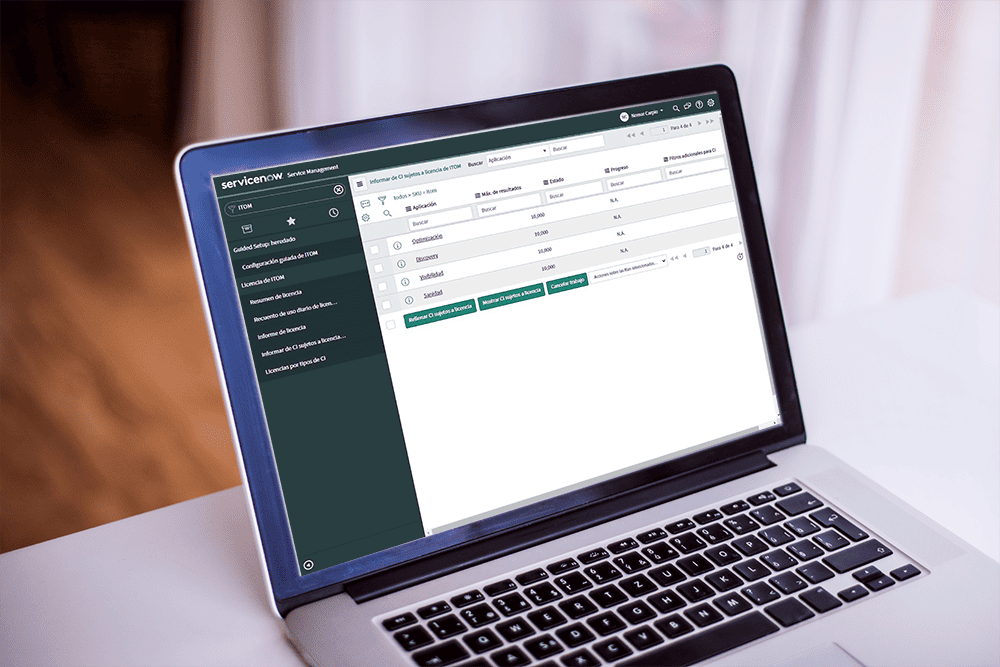

ServiceNow offered an end-to-end solution to the company to improve communication among its employees and optimize operations management. Its IT Operations Management (ITOM) and IT Service Management (ITSM) products were positioned to meet the needs of this organization.

Some outstanding ITSM tools that made work easier for the IT agents at AvanceCapital were:

- Service Operations WorkSpace: Combines IT operations and service management skills, offering a unified experience with streamlined workflows.

- Incident and Problem Management: Facilitates rapid service recovery through intelligent redirection after unplanned outages or major incidents. Investigates root cause to quickly resolve severe outages and eliminate recurring incidents.

- Change Management: Streamlines change management through automated frameworks, reducing friction between IT and DevOps teams. For complex changes, the CAB workspace provides a single, auditable repository of all planned changes.

- Digital Portfolio Management: Unified space that allows owners to view and manage services and applications holistically throughout their lifecycle. It facilitates the planning, and prioritization of tasks, encourages new ideas, optimizes portfolio performance, and supports budgetary decisions.

Other tools that simplified the work of the agents were: Request Management and Knowledge Management. These allowed the rest of the organization and customers to interact with the IT department through an omnichannel platform.

And some crucial ServiceNow ITOM modules for operations optimization were:

- Automated Discovery: It enables businesses to gain visibility into Infrastructure as a Service (IaaS), Platforms as a Service (PaaS) and Functions as a Service (FaaS) with agent-based, agentless, and cloud-native discovery.

- Service Mapping: This platform allows you to determine the infrastructure of your assets and services, establishing the relationships and dependencies between them, so you can quickly determine the cause of service problems.

- CMDB: The Configuration Management Database (CMDB) allows you to better manage the lifecycle of your digital assets and eliminate isolated systems.

These are just some of the tools that AvanceCapital leveraged to transform its services and achieve its goals.

The results: Increased IT efficiency and visibility

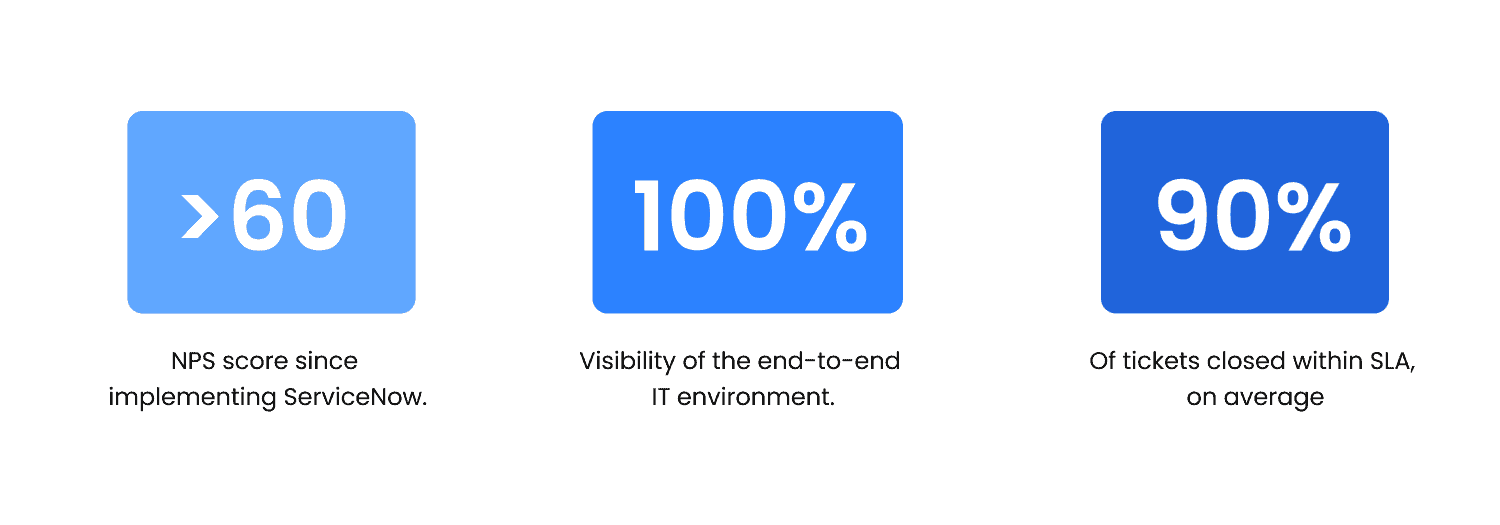

The adoption of ServiceNow achieved the complete financial digital transformation of this company. It generated a positive impact on both the company and its customers. With a centralized and transparent system, employees work more efficiently and in a more coordinated manner. This translates into better service for customers.

In addition, the platform has facilitated communication with customers. Clients can now easily access up-to-date information about their investments and the services offered by the company. This has contributed to increased brand trust and customer satisfaction.

Let’s take a look at some numbers in this regard:

In conclusion, this company’s adoption of ServiceNow has resulted in a real success story in the digital transformation of a financial organization. This way, the company has managed to overcome the challenges associated with its decentralized support system. Thus optimizing the experience of its employees and customers, to establish itself as a leader in its industry.

So, if you would like to learn more about ServiceNow’s capabilities and understand how it brings significant benefits to companies in the financial sector, please do not hesitate to contact us. We will be happy to guide and assist you in the process. 😊