In the mid-1980s, the British Trade Organization began to produce a series of books related to the management of IT services. This, in order to capture their experience in the area and propose good practices to carry out this task.

These publications gave rise to what is now known as the ITIL framework, a fundamental approach to the financial sector. Here are the key points of the ITIL framework for banking today.

What exactly is the ITIL framework?

The ITIL (Information Technology Infrastructure Library) framework consists of a set of books. These documents stipulate the best practices to take advantage of the computer resources in your company; in order to improve its performance and effectiveness.

The library has grown and improved over the years. Currently, they have 12 books. In 26 of them, IT professionals can find standard for management processes like: Service Strategy, Service Design, Service Transition, Service Operation, and Continuous Service Improvement.

Thus, these publications constitute a benchmark when it comes to talking about IT resource management. A great help in the financial sector to optimize operational processes and maintain the performance of fintech. Mostly because ITIL’s priority is not about the tools, but the results.

Good practices for IT management

Among the lessons learned with the ITIL framework, the following IT management practices stand out:

- A good option of the IT management framework is the operation of the processes that support production. This guarantees the control and monitoring of the processes, allowing to innovate and optimize costs.

- Standards recommend having service level agreements (SLAs) based on the following Service Level Agreements (SLAs). These should be willing in all areas related to the production and provision of IT services in your bank. Besides, these regulations specify penalties for non-compliance.

- Your staff must be ITIL certified at the level related to their role in the company.

5 advantages of the ITIL framework for the financial sector

The set of tools proposed by the ITIL framework play a preponderant role in the financial sector. These contribute to catapulting the productivity of the companies that compose it. In this sense, its use in banks brings with it a series of advantages, among which the following stand out:

# 1 Promotes customer satisfaction through the usage of IT

By managing the use of technology in your bank, you’ll be able to add value to your customers’ experience. This will help you make a difference because the organization will mark the quality of the service and allow it to flow smoothly.

In this way, your customers and employees will make better use of the systems, thanks to intuitive interface designs. Thus, you will propose simple, fast and dynamic solutions for front-end users.

# 2 Organizes technology teams

ITIL classifies work teams into four main groups, according to their functions:

- Service desk: It is the IT front office because here the people who work for the customers to meet.

- IT Operations Management: This is where the bank’s operations control and plant management is performed.

- Technical management: The employees of this group manage the system, service, and network of banking platforms.

- Application management: Responsible for the development of software and web applications.

This categorization does not limit the distribution of your staff. In other words, this practice does not prevent a working member from belonging to more than one group or working on two different projects at the same time. The aim is to distribute the roles and responsibilities in order to obtain a better production in the technology department and boost the results.

In addition, these practices distribute the work in a balanced way, avoid delays, reduce downtime and accelerate the internal processes of the company.

# 3 Schematizes the work process

Through ITIL practices, it is possible to define the role of every team member. By doing this, you can enhance the production environment, as everything is done in sequences, ensuring that the final service meets a number of requirements including: design coordination, service level management, service catalog management, supplier management, availability and capacity management, IT service continuity management, and information security management.

# 4 Monitors bank platforms

ITIL framework promotes the daily monitoring of systems and their activities. As a result, you can reduce incidents and the user experience becomes smoother.

This step focuses on ensuring that ongoing operations occur as expected. While IT avoids server problems, network disruptions and hard drives running out of space are prevented.

To this end, these service operations are divided into: event management, incident management, request fulfillment, problem management, and access management, ensuring that any irregularity can be resolved in the shortest possible time.

# 5 Performs continuous improvement in fintech services

Technology is constantly advancing and in order to remain relevant, it must evolve hand in hand with the changes in your bank and its technical environment. For this reason, identifying opportunities in your IT architecture will help you make the necessary changes to remain at the forefront.

To achieve this, ITIL suggests the Deming cycle. This approach consists of planning, executing tests, constantly reviewing and specifying a strategy.

In this sense, the goal is to provide useful experiences through hardware and software, which have value for the customer.

In short, the framework consists of a series of practices that, instead of dictating prescriptive orders and parameters on how to work, delivers solutions that, in the financial sector, are useful for improving service and superimposing results over tools.

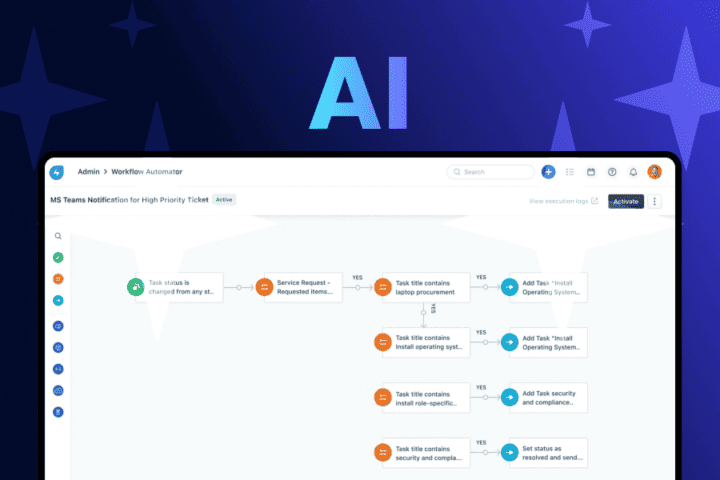

If you are looking for a solution to integrate ITIL protocols into your technology department, we recommend that you ServiceNow. It is one of the best valued IT service management platforms on the market for its automation and task tracking functionalities. Contact us for consultation.